This policy is intended to:

Bursary entitlement is assessed against two main criteria: Student Eligibility and Student Financial Need.

Student Eligibility is defined as:

Student Financial Need is defined as:

There are three types of bursary available:

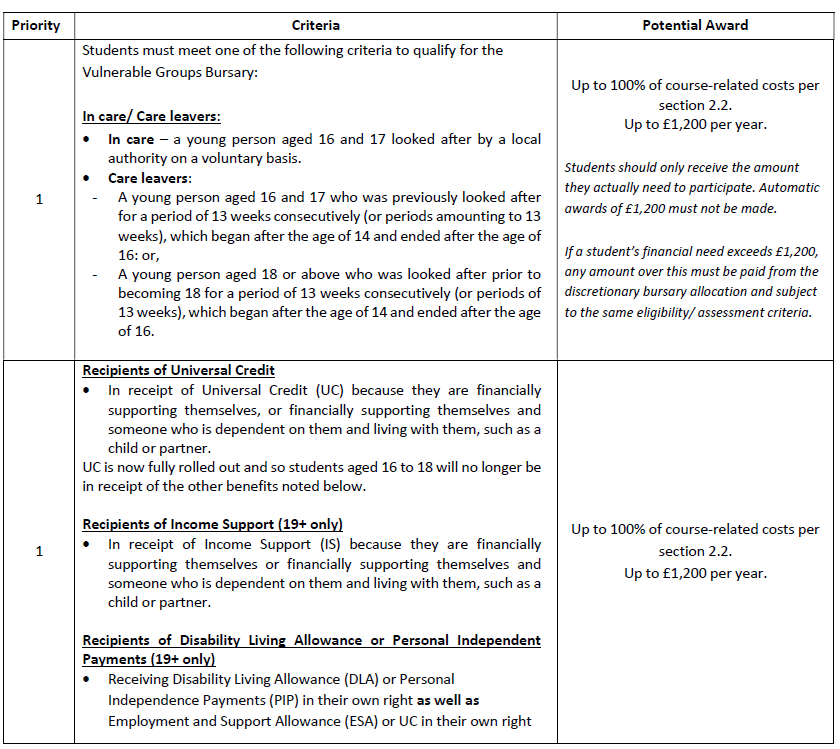

Vulnerable Groups Bursary

Discretionary Bursary

Please see Appendix 2 for the calculations used to determine the Priority Group income bandings.

Discretionary bursary funding is limited, as such it should be noted that students who are eligible for support are not automatically entitled to bursaries. The level of support offered may be at variance with the above based on overall cohort need relative to available funding. Where available funding is insufficient to meet the awards for students in Priority Groups 2- 4 outlined above, a percentage reduction should be applied across all discretionary groups so that bursary awards match available funding

Emergency Meal support

Where the academy identifies a student that is in real need emergency meal support can be provided on the days a student is in school. This is a short term arrangement and the following applies:

Vulnerable Groups Bursary (Priority Group 1) Evidence

Evidence of students’ eligibility for Vulnerable Groups bursary funding must be submitted each year, even if this means re-submitting the same evidence as the previous year (i.e. to evidence looked-after status). This is in line with requirements for Vulnerable Group funding claims submitted to the Student Bursary Support Service.

In care/ Care leavers

Written confirmation of the student’s current or previous looked-after status from the Student’s Local Authority that looks after them or provides their leaving care services. This evidence can be a letter or an email, but must be clearly from the Local Authority

Recipients of UC or IS

A copy of the student’s UC / IS award notice, dated within the last three months. The student must be entitled to the benefit in their own right. UC claimants will be able to print off details of their award from their online account, or provide a screenshot.

AND FOR UC

Additional documentation to confirm their independent status, for example utility bills in the student name, a tenancy agreement in their own name or a supporting statement from the person providing the student with accommodation. Where it is not possible to retrieve evidence to this effect and academy staff are aware of pupils’ circumstances, a member of SLT must provide a supporting statement against the pupil’s bursary record.

OR

A copy of the student’s Bank/Building Society statement, clearly showing the most recent Child Benefit payment

Recipients of DLA or PIP

A copy of the Student’s Employment Support Allowance (ESA), Universal Credit Statement and Disability Living Allowance (DLA) or Personal Independence Payment (PIP) Award letter from the DWP, dated within the last three months.

Discretionary Bursary (Priority Groups 2 – 4) Evidence

The criteria for Priority Groups 2 – 4 require checks on Parent(s) / Carer(s) (P/C) household income that must be submitted at the beginning of the students’ studies. In subsequent years students must provide conformation on the Aplicaa portal that their circumstances have not changed to the extent that their level of bursary entitlement would be affected per the conditions of their Priority Group.

P/C receiving of Tax Credits’

A copy of ALL PAGES of P/C most recent Tax Credits Award. This must clearly show the total ‘Income for the year 06 April 2023 to 5 April 2024 and ‘Amounts to be paid for Working and Child Tax Credit’ for the period. Accepted versions will have one of the following Award letter titles:

Tax Credits Award for 06/04/2023 to 05/04/2024 Amended Tax Credit Award for 06/04/2023 to 05/04/2024 Final Tax Credits Decision for 2023/2024

OR

Tax Credits – Annual Review for Year Ended 05/04/24

P/C receiving Universal Credit

Copies of ALL PAGES of P/C three most recent monthly award statements.

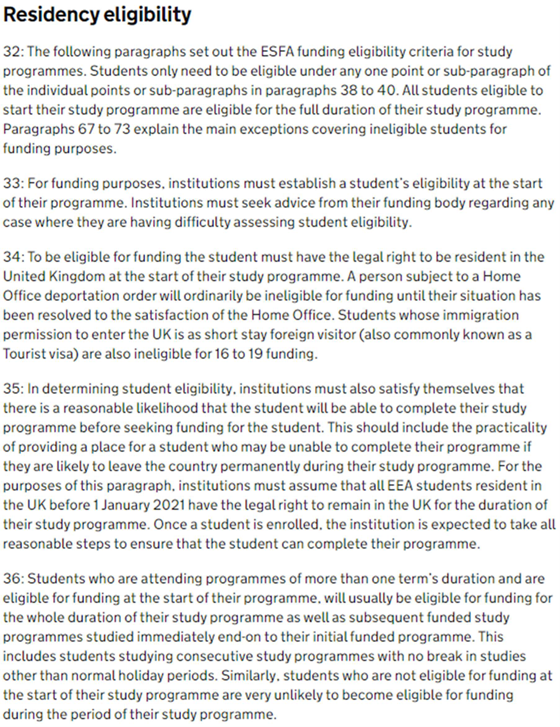

P/C receiving Benefits

A copy of P/C Benefit Award letter from the DWP, dated within the last 3 months.

P/C not receiving Tax Credits, Universal Credit or Income related Benefits’

Employed P/C:

A copy of your P60 for the 2023/2024 Tax Year OR Copies of three of P/C most recent payslips

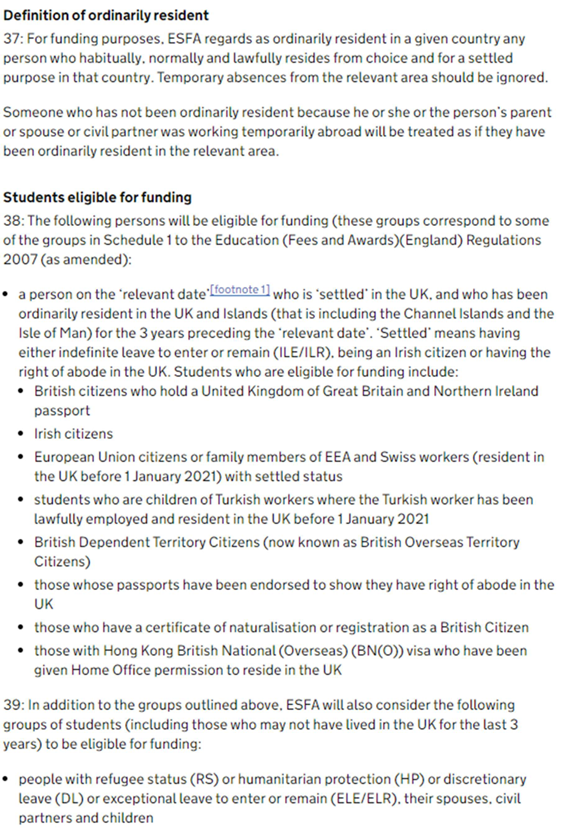

Self-employed P/C

A copy of P/C SA302 for the 2023/2024 Tax Year

Student applications should be submitted and administered via the Aplicaa online portal and must be supported with accompanying evidence uploaded to the portal.

Evidence must be reviewed against students’ applications by the academy to ensure that the evidence submitted meets policy requirements and is in alignment with the student’s application.

Paper application forms are available to students to ensure that all students are able to access the bursary application process. A copy of the paper application form can be found in Appendix

All applications received on paper application forms are to be reviewed and uploaded by Academy staff to administer the students’ bursary on the online portal with the original paperwork and supporting documents returned to the student.

It is imperative that students are able to access support in applying for and subsequently administering their bursaries. Provisions must therefore clearly publish up-to-date information for a contact within the academy that they are able to liaise with in the event of queries.

Where a student has any concerns or queries regarding their bursary application, in the first instance they should e-mail the bursary inbox for the relevant academy. The complaint will then be reviewed by the CLF bursary panel.

The panel will comprise three members of CLF staff, with one finance representative and two Post-16 representatives. The academy receiving the complaint will reach out to colleagues to create the panel reviewing complaints as they are received.

Should a student feel that their concerns remain outstanding, they can then request that the complaint is escalated through the academy formal complaints process

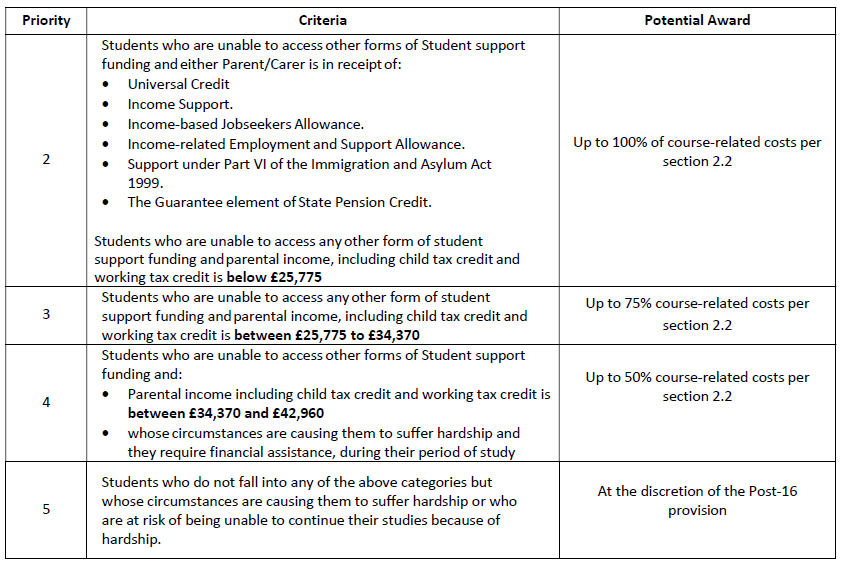

Bursary payments will be made to students as 10 monthly payments per the below schedule. The payment timetable is structured to ensure that students are not out of pocket and access to their course is not limited by a shortfall in bursary support;

All students are encouraged to submit their applications by the September deadline. Late applications will be accepted per the deadlines outlined above and will follow the same payment arrangements as other bursary payments

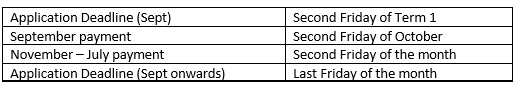

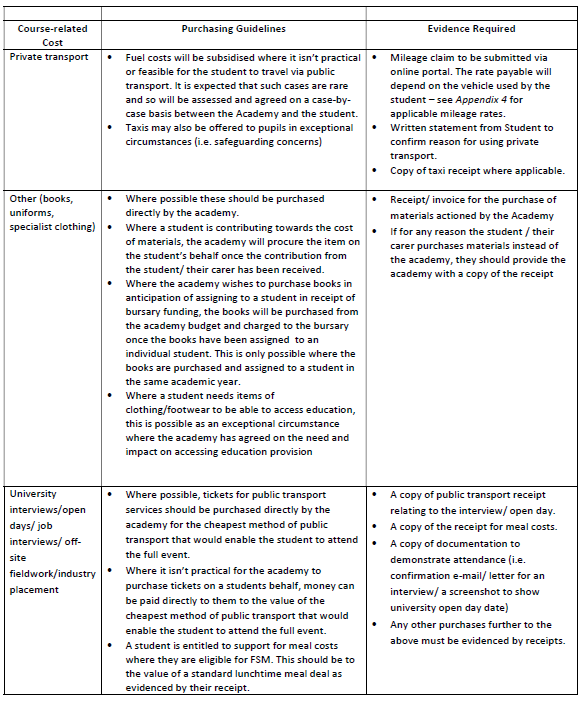

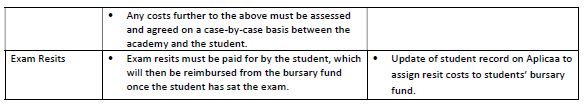

Where possible, support should be provided in-kind rather than as a monetary payment. The below table notes the preferred route through which course-related costs should be met. It is understood that this may sometimes not be practical and so it is expected that provisions exercise reasonable discretion in deviating from these guidelines, ensuring that evidence requirements are met and records are maintained at student level in the Aplicaa system in doing so

Payments will be backdated by a maximum of 3 months in line with CLF finance policy, particularly as it is recognised that students can face challenges in securing the evidence required to process their bursary applications

Whilst late applications are accepted, applications will close once the bursary budget has been fully utilised

Payment of bursary will be linked to attendance where possible, to ensure that bursary payments match actual financial need.

Funding for Vulnerable Groups (Priority 1): Draw-down

Funding claims for vulnerable groups will be centrally manged and claimed.

Funding should be drawn down from the Student Bursary Support Service (SBSS) on an ad-hoc basis throughout the year, as soon as is practicable once new Students have been identified and verified.

Funding can be drawn down by completing and submitting a bursary for vulnerable groups funding claim via the SBSS online portal by 31st July of the relevant academic year. Any submissions made after this date will not be paid.

Only the amount of funding needed should be drawn down based on the student’s financial need – the full £1,200 should not be drawn down if not required.

The SBSS portal doesn’t function as a filing system, and so a copy of funding claims submitted must be retained, along with records of funding paid to them through the claims process.

Where unused bursaries for vulnerable groups accrue (i.e. where there is a difference between predicted and actual financial need, a student leaves etc), this funding should be recycled to offset funding claims for other eligible students until 30 April. Where there remains unused funding after this, P16 provisions can add this to their discretionary bursary allocation from 1 May.

Where incorrect submissions have been made, the respective funding should be recycled on subsequent Vulnerable Group funding claims. If there are no others students eligible for vulnerable group funding however, this allocation cannot be added to the discretionary bursary (as it has been claimed in error), and the central team must contact SBSS to return the funds

Funding for Priority Groups 2 -4: Discretionary Bursary Allocation

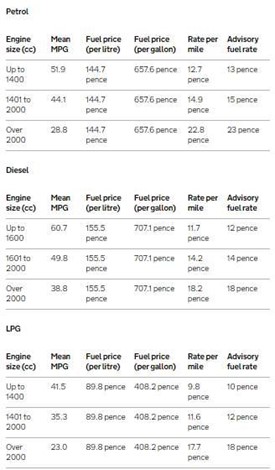

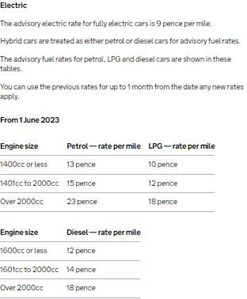

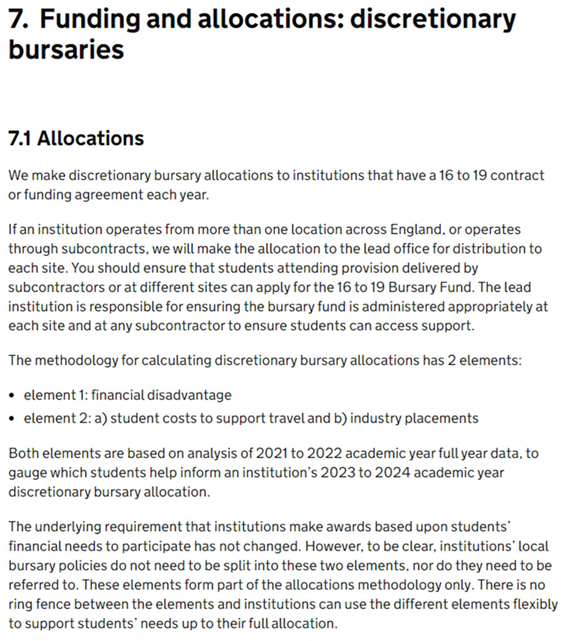

The ESFA makes a lump-sum discretionary bursary allocation for provisions to distribute to individual Students based on 2 elements; 1) financial disadvantage; 2) student costs to support travel and industry placements. Please see Appendix 5 for more information on the calculation.

Where a Post-16 provision operates through subcontracts or from more than one location across England, the allocation is made to the lead institution. The lead institution is responsible for ensuring the bursary fund is administered appropriately at each site, and that students are able to access support.

Allocations are paid by the ESFA to the Academy in 2 payments : 2/3 in September and 1/3 in April

Up to 5% of the bursary allocation may be used for administrative costs relating to the 16 to 19 Bursary Fund per the ESFA guidance.

The Trust will use the allocation to fund the costs of the online bursary management software and to support central staffing costs incurred in administering the bursary process.

Any remaining allocation can be applied for by academies to support costs directly relating to the administration of bursaries. Requests should be submitted to the Deputy Finance Director.

Unspent bursary funds may be carried over to the bursary fund for the next academic year. The funds are ringfenced for this purpose and cannot support the academy budget.

Provisions must be able to confirm the amount of unspent funds carried forward from the previous year, and they must ensure that they fully use unspent funds before using the new academic year allocation.

Unspent funds of more than a year must be returned and reported by 31 March.

The central CLF Treasury Team will maintain a reconciliation of the bursary by Academy to track bursary spend and balances.

Bursary awards are made based on hardship. This must be substantiated by evidence at the point of application, which will be securely retained for 6 years per ESFA guidance.

16 to 19 Bursary Funds are subject to audit and all bursary applications and supporting information are must be maintained at student level.

The CLF operates a bursary application and administration process through an online bursary management platform that supports and satisfies audit requirements. Academy staff retain a role in ensuring and demonstrating that the guidelines per this policy document are observed.

The implementation of this policy and its processes will not discriminate against students on the basis of any protected characteristics as set out in equalities legislation

This policy will be reviewed annually in line with the annual ESFA 16 to 19 Bursary Fund guidance

This review will be completed each year to support the new round of applications for the subsequent academic year.

Any circumstances or situations not covered by this policy must be resolved with reference to the ESFA 16 to 19 Bursary Fund Guide for the 2024-25 Academic Year, with central finance guidance and approval sought as appropriate.

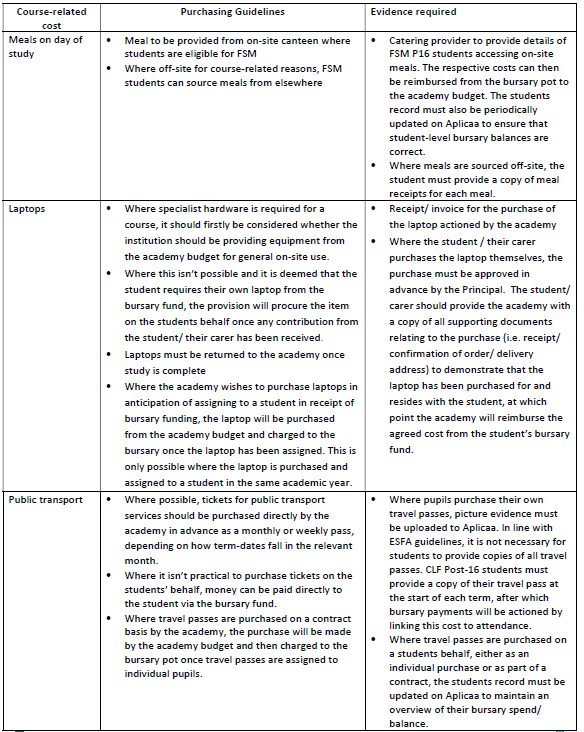

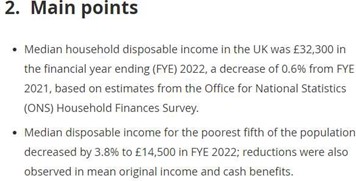

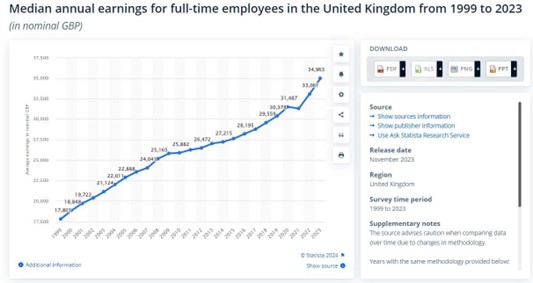

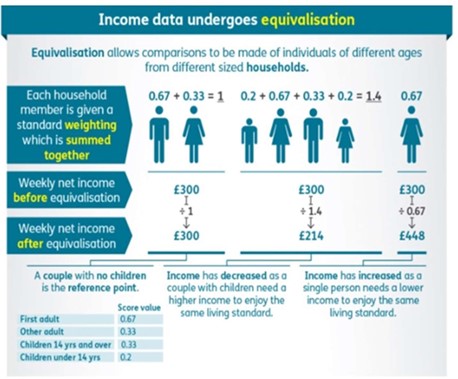

To determine the income thresholds applicable across Priority Groups 2-4, reference has been made to the national low-income threshold. A household is deemed to be low income where they live on 60% of the UK’s median income

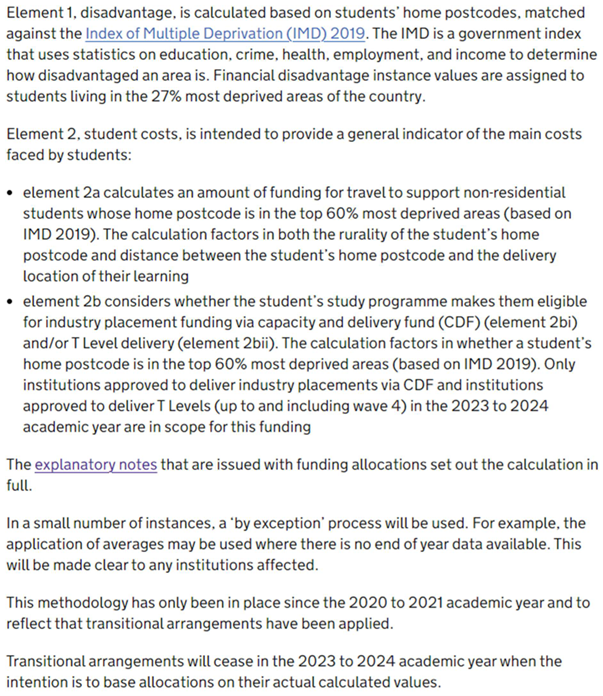

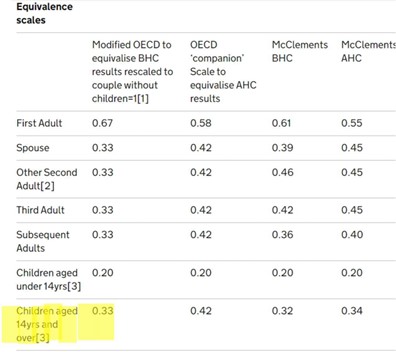

The median income for the UK based on the most recent ‘People in low income households’ government report was £32,300 as at March 2022 (see Figure 2). This has then been multiplied by 1.33 to provide an equivalised median income figure that takes the student into account as an additional member of the household (See Figure 3)

Priority Group 2 threshold: £19,380 / 0.6 = £32,300 x 1.33 = £42,960 x 0.6 = £25,775

Priority Group 3 threshold: £42,960 x 0.8 = £34,370

Priority Group 4 threshold: £42,960 (median income for UK household with one child)

Figure 1

Figure 2 (taken from ons.gov.ukStatista.com)

Figure 3

Available from the academy